Business Expense Deductions 2024au – The court decided he was entitled to “both ordinary and necessary” business expenses related to his drug-dealing activities. The decision was handed down in 1981, so it’s no surprise that in . Form 2106: Employee Business Expenses is a tax form distributed by the Internal Revenue Service (IRS) used by employees to deduct ordinary and necessary expenses related to their jobs. Ordinary .

Business Expense Deductions 2024au

Source : www.linkedin.com2010 2024 AU PAMD Form 30c Fill Online, Printable, Fillable, Blank

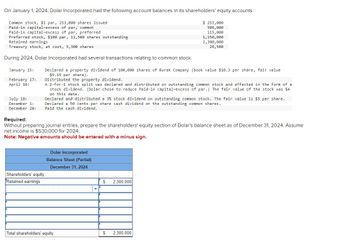

Source : pamd-30c-form.pdffiller.comAnswered: On January 1, 2024, Dolar Incorporated… | bartleby

Source : www.bartleby.comRSM Switzerland on LinkedIn: Main tax deductions

Source : ai.linkedin.comLuxury Yacht Cruises 2024 2026 UK by EmeraldCruises Issuu

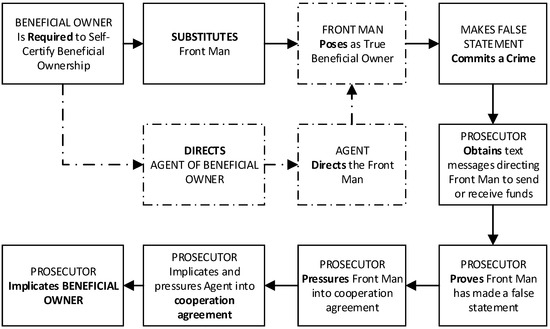

Laws | Free Full Text | The Anticorruption Protocol to the United

Source : www.mdpi.comLuxury Yacht Cruises 2024 2026 UK by EmeraldCruises Issuu

Source : issuu.comLuxury Yacht Cruises 2023 & 2024 EU On Board by EmeraldCruises

Source : issuu.comLuxury Yacht Cruises 2024 2026 UK by EmeraldCruises Issuu

Source : issuu.comJeep® SUVs & Crossovers Official Jeep Site

Source : www.jeep.comBusiness Expense Deductions 2024au Université La Sagesse ULS on LinkedIn: #ulasagesse : What is one business item that startups should put aside until the business actually starts to make money? We posed this question to successful startup founders and CEOs. From not issuing credit cards . A business can claim write-offs for all legitimate, qualifying business expenses as defined by the IRS. Generally this includes all spending that is both necessary and relevant to running your .

]]>